Blank #1 appreciate or

Blank #2 $2 per euro, $1.5 per euro, or $2.5 per euro

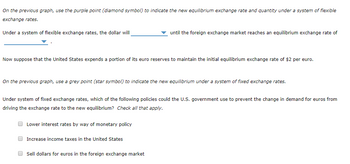

Transcribed Image Text:On the previous graph, use the purple point (diamond symbol) to indicate the new equilibrium exchange rate and quantity under a system of flexible

exchange rates.

Under a system of flexible exchange rates, the dollar will

Now suppose that the United States expends a portion of its euro reserves to maintain the initial equilibrium exchange rate of $2 per euro.

On the previous graph, use a grey point (star symbol) to indicate the new equilibrium under a system of fixed exchange rates.

until the foreign exchange market reaches an equilibrium exchange rate of

Under system of fixed exchange rates, which of the following policies could the U.S. government use to prevent the change in demand for euros from

driving the exchange rate to the new equilibrium? Check all that apply.

Lower interest rates by way of monetary policy

Increase income taxes in the United States

Sell dollars for euros in the foreign exchange market

exchange rates.

Under a system of flexible exchange rates, the dollar will

Now suppose that the United States expends a portion of its euro reserves to maintain the initial equilibrium exchange rate of $2 per euro.

On the previous graph, use a grey point (star symbol) to indicate the new equilibrium under a system of fixed exchange rates.

until the foreign exchange market reaches an equilibrium exchange rate of

Under system of fixed exchange rates, which of the following policies could the U.S. government use to prevent the change in demand for euros from

driving the exchange rate to the new equilibrium? Check all that apply.

Lower interest rates by way of monetary policy

Increase income taxes in the United States

Sell dollars for euros in the foreign exchange market

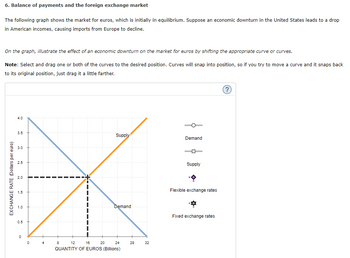

Transcribed Image Text:6. Balance of payments and the foreign exchange market

The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic downturn in the United States leads to a drop

in American incomes, causing imports from Europe to decline.

On the graph, illustrate the effect of an economic downturn on the market for euros by shifting the appropriate curve or curves.

Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back

to its original position, just drag it a little farther.

EXCHANGE RATE (Dollars per euro)

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0

0

8

12

24

QUANTITY OF EUROS (Billions)

16

Supply

20

Demand

28

32

Demand

Supply

Flexible exchange rates

Fixed exchange rates

(?)

The following graph shows the market for euros, which is initially in equilibrium. Suppose an economic downturn in the United States leads to a drop

in American incomes, causing imports from Europe to decline.

On the graph, illustrate the effect of an economic downturn on the market for euros by shifting the appropriate curve or curves.

Note: Select and drag one or both of the curves to the desired position. Curves will snap into position, so if you try to move a curve and it snaps back

to its original position, just drag it a little farther.

EXCHANGE RATE (Dollars per euro)

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0

0

8

12

24

QUANTITY OF EUROS (Billions)

16

Supply

20

Demand

28

32

Demand

Supply

Flexible exchange rates

Fixed exchange rates

(?)