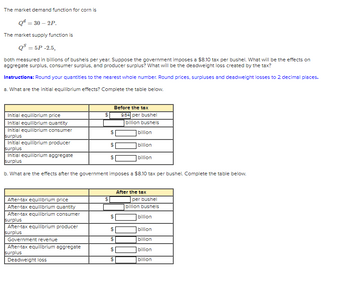

Transcribed Image Text:The market demand function for corn is

Q = 30 – 2P.

The market supply function is

QS = 5P-2.5,

both measured in billions of bushels per year. Suppose the government imposes a $8.10 tax per bushel. What will be the effects on

aggregate surplus, consumer surplus, and producer surplus? What will be the deadweight loss created by the tax?

Instructions: Round your quantities to the nearest whole number. Round prices, surpluses and deadweight losses to 2 decimal places.

a. What are the initial equilibrium effects? Complete the table below.

Initial equilibrium price

Initial equilibrium quantity

Initial equilibrium consumer

surplus

Initial equilibrium producer

surplus

After-tax equilibrium price

After-tax equilibrium quantity

After-tax equilibrium consumer

surplus

After-tax equilibrium producer

surplus

$

Government revenue

After-tax equilibrium aggregate

surplus

Deadweight loss

Before the tax

Initial equilibrium aggregate

surplus

b. What are the effects after the government imposes a $8.10 tax per bushel. Complete the table below.

$

$

$

9.64 per bushel

billion bushels

billion

$

$

$

$

billion

billion

After the tax

per bushel

billion bushels

billion

billion

billion

billion

billion

Q = 30 – 2P.

The market supply function is

QS = 5P-2.5,

both measured in billions of bushels per year. Suppose the government imposes a $8.10 tax per bushel. What will be the effects on

aggregate surplus, consumer surplus, and producer surplus? What will be the deadweight loss created by the tax?

Instructions: Round your quantities to the nearest whole number. Round prices, surpluses and deadweight losses to 2 decimal places.

a. What are the initial equilibrium effects? Complete the table below.

Initial equilibrium price

Initial equilibrium quantity

Initial equilibrium consumer

surplus

Initial equilibrium producer

surplus

After-tax equilibrium price

After-tax equilibrium quantity

After-tax equilibrium consumer

surplus

After-tax equilibrium producer

surplus

$

Government revenue

After-tax equilibrium aggregate

surplus

Deadweight loss

Before the tax

Initial equilibrium aggregate

surplus

b. What are the effects after the government imposes a $8.10 tax per bushel. Complete the table below.

$

$

$

9.64 per bushel

billion bushels

billion

$

$

$

$

billion

billion

After the tax

per bushel

billion bushels

billion

billion

billion

billion

billion