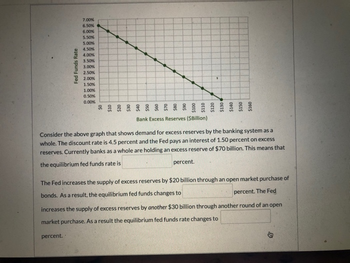

Transcribed Image Text:Fed Funds Rate

7.00%

6.50%

6.00%

5.50%

5.00%

4.50%

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

$130

$140

$150

$160

Bank Excess Reserves ($Billion)

banking

system as a

Consider the above graph that shows demand for excess reserves by the

whole. The discount rate is 4.5 percent and the Fed pays an interest of 1.50 percent on excess

reserves. Currently banks as a whole are holding an excess reserve of $70 billion. This means that

the equilibrium fed funds rate is

percent.

percent..

The Fed increases the supply of excess reserves by $20 billion through an open market purchase of

bonds. As a result, the equilibrium fed funds changes to

percent. The Fed

increases the supply of excess reserves by another $30 billion through another round of an open

market purchase. As a result the equilibrium fed funds rate changes to

7.00%

6.50%

6.00%

5.50%

5.00%

4.50%

4.00%

3.50%

3.00%

2.50%

2.00%

1.50%

1.00%

0.50%

0.00%

$130

$140

$150

$160

Bank Excess Reserves ($Billion)

banking

system as a

Consider the above graph that shows demand for excess reserves by the

whole. The discount rate is 4.5 percent and the Fed pays an interest of 1.50 percent on excess

reserves. Currently banks as a whole are holding an excess reserve of $70 billion. This means that

the equilibrium fed funds rate is

percent.

percent..

The Fed increases the supply of excess reserves by $20 billion through an open market purchase of

bonds. As a result, the equilibrium fed funds changes to

percent. The Fed

increases the supply of excess reserves by another $30 billion through another round of an open

market purchase. As a result the equilibrium fed funds rate changes to